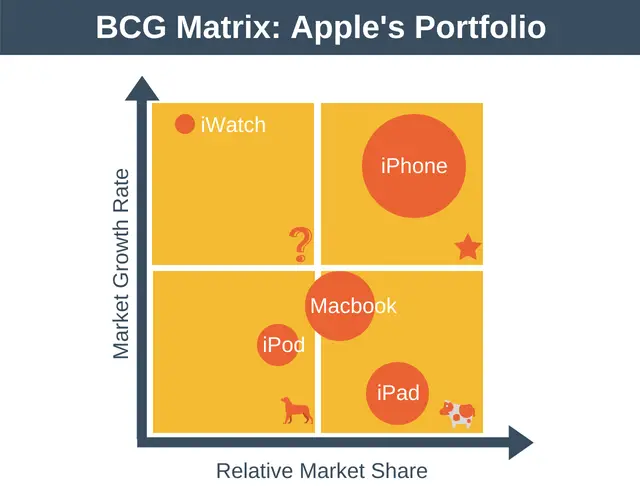

This is why the matrix highlights the level of cash consumption required versus the resulting cash generation. Equally, it assumes that to establish a product in a growing market will require continual investment to produce the goods/services and to increase capacity. Over the years iTunes, MacBook and iMac’s have attained the position of being a Cash Cow for thecompany.

The underlying foundation of Bruce Henderson's model is that an increase in market share will result in an improvement in cash generation. CASH COWS:There are two products of Apple that fall under the Cash Cow category of BCG Matrix of Apple, the first being Apple iTunes and the second being Apple MacBook and iMac’s.

The x-axis generally denotes the market growth rate, or cash usage - with the y-axis denoting relative market share, or cash generation.īruce Henderson reasoned that established and mature areas of a business where required to generate significant income (cash cows) which could then be invested into new highly profitable market leading products (stars). The matrix is scored from low to high on both the x-axis and y-axis. If Apple can solve a few ecosystem problems, they could really own the. The quadrants are split into combinations of "market growth" and "market share", hence also being known as the growth-share matrix or growth-market-share matrix. Question Mark- Apple TV makes a bit of money, but its not reaching its potential. The concept is based on four quadrants in which a company's strategic business units (SBU) or products/brands are classified. Devised as a portfolio planning tool, or corporate planning tool, the BCG growth-share matrix was first conceived by Bruce Henderson of the Boston Consulting Group back in the 1970's.

0 kommentar(er)

0 kommentar(er)